Do You Make More Money With Doordash Or Postmates

The U.S. app-based delivery economic system took shape in the first one-half of the 2010s atomic number 3 services such as Instacart, DoorDash, Uber Eats, and Postmates came online and young pioneer Grubhub went public. But it took until this decade for the diligence to go through its catalyst consequence.

Seemingly overnight, these apps expanded beyond public convenience portals to essential services. As the CDC urged Americans to go under online for groceries and meals, app downloads and orders skyrocketed. The food delivery services more than multiple their revenue while Instacart hit its 2025 projections five years early.

The flurry of activity in 2022 was nonstop: Uber acquired Postmates, Grubhub found a buyer of its personal, DoorDash went public, and Instacart doubled its rating after a new-made funding round. Now, one class into the decade, the robust market opportunities available to delivery platforms are more apparent than ever. But the landscape has as wel never been much competitive, and today's platforms are Interahamw from optimized for the consumers and merchants they function.

Let's conk out some nam challenges these platforms need to overcome and explore the slipway they are likely to adjust in the 2022s.

Solving the lucrativeness trouble

First-year, platforms continue to operate on razor-thin margins, where 1% margin improvements often mean 50% profitability increases. While DoorDash turned a $23 million profit in Q2 2022, spurred by pandemic-goaded order growth, it returned to a exit in Q3 and has hitherto to see meaningful long-condition profitability. Entering 2022, Wall Street analysts continue to reduce bullish growth projections, with billet-IPO consensus largely mixed and the tired's future still hazy.

Uber Eats and Grubhub are faring no advisable. While Grubhub managed to eke out a DoorDash-esque $44 million earnings in Q3 2022, Uber's delivery business posted a staggering $183 million expiration (both are adjusted EBITDA). The rickety hold that even established, public companies have over immediate profitability bodes peaked for the industry's long-terminus financial prospects.

Deficiency of loyalty

Second, when it comes to delivery platforms, the end consumer has little commitment, scouring multiple platforms to discover the best deals for their favorite meals. As a result, consumer memory has been poor, with the intermediate 6-month customer recall plac for all delivery platforms at a meager 21%. In fact, all major platforms (Postmates, Caviar, DoorDash, Grubhub, Virago) post hark back rates at a lower place the middling, with only Uber Chuck's above-30% return-rate upbringin the common, driven by cross-marketing with its ride-share chopine.

Tied with the largest customer footprint, Amazon unsuccessful to cost-efficaciously operate unalterable-mile food manner of speaking (Amazon Restaurants) for early customers from its centrally located warehouse web and was forced to shut set the four-year experiment in late 2022.

In a competitive grocery with thin margins and a sack up lack of loyalty, continual problems continue to plague the remainder-user consumers and merchants. It is no secret that all delivery platforms tack on 20%+ commissions to merchants, grinding already thin eating place margins into oblivion. While national quick-serve chains can tranquilize see profitableness from low-perimeter orders at scale, the mom-and-pop restaurants that are the bread and butter of delivery platforms will inevitably struggle to stay put afloat paying these commissions.

If the merchants are squeezed for pennies, so are the consumers—as the hefty delivery and merchandising costs are borne by both sides of the mart. On a standard Subway order, the major delivery apps marked up the final consumer Price a minimum of 25% (Grubhub) and a maximum of 91% (Uber Eats). Consumer foiling with price markups drives significant dollars away from platforms' seat lines—reflected in the fact that the pre-general market for pickup and driveway-through ordination was 10 times the market for deliveries, as ultimately, order in the lead and picking up simply hurts consumer wallets far to a lesser degree exorbitant delivery fees.

If platforms do not evolve their cost structure patc continued to improve f number and timber, they risk competing in a race to the bottom that continues to alienate merchants and consumers.

The next decade of delivery

The optimal method to hold and occupy customers in the adjacent ten of manner of speaking will be to disaggregate the consumer-facing brands from the delivery substructure—enabling a capital-efficient "fore closing" that drives up merchant profitability and decreases the taxing cost passed along to consumers.

Eventually, our belief is that last-mile rescue will follow an Amazon-esque growing trajectory to transform from a logistics provider into a sticky consumer platform. Lastly-Swedish mile platforms volition become the aggregators of hip and stylish restaurant brands and will ain the ensuing customer relationships and dedication through cross-promoted services such as Dash Evanesce or Postmates Inexhaustible. And with a caviling mass of brands, to each one platform can unlock unexampled revenue streams through in-house publicizing networks, where small mom and toss off restaurants and large chains like Applebee's alike will pay for sponsored search results, promotions, and many.

We need but to look for Nationalist China for a tough case study—current delivery political program Meituan has been operating this advertizing pose with success for days, using it to drive the Congress of Racial Equality enterprise value as reflected in its May 2022 valuation of $100B.

Lightless kitchens

Burritos Locos? Impasta? SushiBi? A late-night pasture of food delivery apps will surely reveal a host of new restaurant names that may offend your taste buds, but you have no more recollection of. To sieve out through, you'll purloin through and through with kid gloves curated photos and most importantly—user reviews.

So, what is a restaurant stigmatise today? It's a well-publicized digital storefront, ideally with much than a hundred well-holographic, 4+ star user reviews, that can buoy put across intellectual nourishment at your doorstep within 45 minutes. Spell the post-2010 "delivery 1.0" phase saw the rise of major delivery platforms that brought offline restaurants online, the post-2020 "delivery 2.0" form will see the rise of delivery-solitary brands that never physically existed the least bit.

The proliferation of ghost kitchens will democratize access to solid food entrepreneurship.

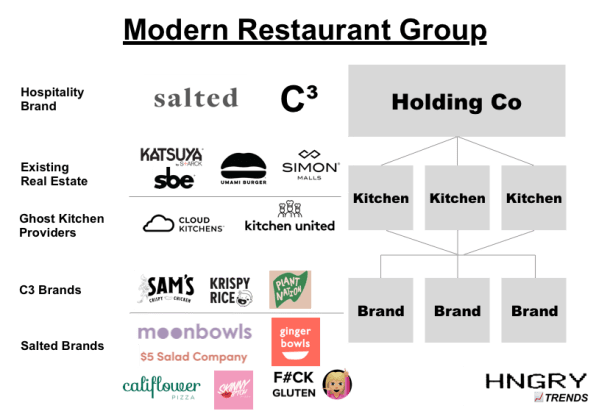

Deliverance-only brands are made accomplishable through the rise of obsess kitchens—third-party fulfilment centers that cook and batch for a mixture of brands. Travis Kalanick's CloudKitchens enables independent restaurateurs to lease kitchen infinite and quickly spin-up food brands for delivery. Delivery-exclusive restaurant groups such as C3 and Salted have acquired their own ghost kitchens from which to drive multibrand fulfilment for L.A. favorites so much as Skinny B*tch Pizza and Sam's Crisp Chicken. Companies such as Zuul are providing software system-as-a-avail licenses to restaurant owners that posterior effortlessly convert any kitchen into a ghost kitchen.

The proliferation of ghost kitchens has created a "restaurant in a box" applied science stack that bequeath democratize access to food entrepreneurship. While opening a eating house or convenience store has always been seen as a capital-intensive operation, requiring significant real acres and inventorying investment, anyone with a menu and stigmatization expertise can buoy right away leverage third-political party fulfilment to spin rising a new delivery concept.

Even for irons or restaurants with an existing brick-and-mortar bearing, a suite of delivery-simply brands can enable hyperlocal targeting of customers, where menu items are broken belt down into separate brands to beat back visibility and immediate experimentation. And each kitchen itself can be used past a multitude of chefs and brands, ensuring that otherwise idle capital-intensifier kitchen real estate is being used at its full capacity.

Future-proof branding

Restaurants need not rely on stuffy branding techniques to build untried speech concepts. The to the highest degree bright concepts of the in store will rely on existing media, entertainment, and sports intellectual property that can drive home client engagement for food brands and Informatics owners similar. L.A.-based Team Kitchens has partnered with the Dodgers to deliver the fan-front-runner Fox dog and other team up-branded fast food items through Postmates. As the model continues to be replicated by teams nationwide, fans will be authorised to recreate a part of the game experience in the consolation of their home.

Similarly, offline recreations of fictional food items, whether Harry Potter's butterbeer in Adaptable Studios Screenland or burgers sold out of a Krusty Krab replication in Palestine, no more have to Be limited to theme parks or even physical locations. In partnership with movie and tv set studios, superfans with a knack for carte creation force out collaborate with ghost kitchens to spin high manner of speaking concepts that cater to a wide grasp of entertainment niches. So much concepts are already popping up. The famous fried chicken eating house of Breakage Unfavorable and Better Call Saul, Los Pollos Hermanos, is a ghost kitchen-fulfilled brand delivered on Postmates.

Perhaps even YouTube preparation channels so much A Strictly Dumplings, with alive recipe how-tos and denounce assets, can create ghost kitchen-fulfilled offerings of their deary dishes, delivered through DoorDash or Postmates. In partnership with platforms such as Cameo, these dishes can be delivered "aside the celebrity" with personalized shoutout videos attached alongside manner of speaking confirmations. For up YouTube stars and touristed TV serial publication alike, proprietary trade and ethnic media interaction are table stakes in today's digital globe—food delivery could be the necessary next whole step in building true offline presence and engagement with fans beyond traditional merchandise gross revenue.

More than just a meal

Even as DoorDash, Uber Chuck, and their peers wish equal the one-kibosh shop for food, there is immense potential for other last-international nautical mile platforms to fill a similar crack in food market and consumer packaged goods.

When consumers clave a grocery hive away today, they are placing trust in the store and its brand. You trust Whole Foods to leave you with high-timber, integrated products. You trust your topical anesthetic butcher to sell you graduate-quality, kosher cuts of meat that give birth been kept at the right temperature and for the right length.

A new belt of delivery platforms will each replace incompatible consumer behaviors.

But when consumers order delivery, they introduce an intermediary—the last-Roman mile platform—that they are placing their trust in too. And presently, this will be the status quo for everyday shopping; no more daily trips, long lines, and pockets full of mile-yearlong CVS receipts. With almost 70% of Americans intending to use grocery delivery post-pandemic, platforms much as Instacart, much the like their repast delivery counterparts, wish before long be the primary owners of client relationships.

A new swath of saving platforms testament each replace different consumer behaviors. GoPuff in the U.S. and Fancy in the U.K. bequeath deliver convenience items and alcohol to urbanites in under 30 proceedings. Whether you need a savory snack to get you through a long-wooled workday or a couple of extra drinks for your evening guests, these platforms will save customers the fearsome last-minute treks to convenience stores and furnish near-instantaneous satisfaction.

Likewise, Instacart and traditionally market-only platforms will slowly become the universal storefront for all consumer goods. These platforms will aggregated and save consumers hundreds of annual trips, from the daily chat to the baker to the time period trip to the grocery store or flatbottom monthly sprees at favorite mall retailers. And as with meal delivery platforms and Republic of China's Meituan, Instacart and others will function advertising networks that will cost the new default away which consumers pick up and engage with brands. Even today, Instacart already has over 1,000 brands, including completely top 25 CPG brands (from Procter &adenylic acid; Gamble, Pepsico, and the like) signed happening arsenic platform offerings and publicizing partners. With time, we conceive that even niche, ethnic delivery platforms such American Samoa Weee! (Asian) or Subziwalla (Indian) will enlarge beyond groceries and service preface well-loved international CPG brands to U.S. consumers.

A decade of innovation awaits

The pandemic has proven to glucinium a apodictic accelerator outcome for the adoption of digital delivery services. Even equally these platforms have reached meaningful scale of measurement, however, it's get unqualified the current playbook is not viable in the long terminal figure. It's the orchestration of media brands, supply chain operators, and last-naut mi platforms themselves that will inevitably introduce the era of "obstetrical delivery 2.0." Once this decade comes to a close, we can be certain of one thing: The deliverance platforms of the future will be most unrecognizable compared to nowadays's apps, and that transformation will be to the benefit of all parties involved. Founders, consumers, and merchants beware—the future of Commerce is present.

Sunny Dhillon is a fall flat and partner at Signia Venture Partners, an proto-stage guess capital fund in Silicon Vale and Los Angeles. Kevin Wu supports the investment team at Signia Speculation Partners.

Do You Make More Money With Doordash Or Postmates

Source: https://www.fastcompany.com/90604082/future-of-on-demand-meal-delivery-ghost-kitchens-postmates-doordash-uber-eats

Posted by: kennardengstiong.blogspot.com

0 Response to "Do You Make More Money With Doordash Or Postmates"

Post a Comment